BharatPe

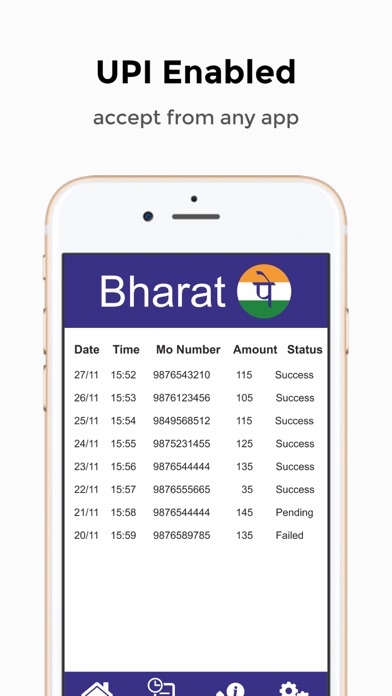

BharatPe is a payments app that allows merchants to accept payments from any UPI app - PhonePe, PayTM, GooglePe, BHIM, and 150+ others with your BharatPe QR. Additionally, customers can pay through multiple modes like Bank Account, RuPay Credit card and Wallet etc on BharatPe QR.

BharatPe also offers on-demand settlement (settle money to your bank account anytime) and day-end auto settlement.

From the BharatPe app, you can order BharatSwipe card machines to accept all debit and credit cards. This comes with multiple features like a free trial period, monthly rental offer, instant payment settlement, and receipt printing for card and QR transactions.

You can invest your collections to earn up to 12% interest per annum.

Get loans to grow your business

BharatPe provides loans at a very low-interest rate and without any paperwork. It is a 100% online application process, without any security or guarantee. You can repay the loan amount through Easy Daily Installment (EDI).

Repayment Terms:

Repay in Easy Daily Installments (EDI)

Loan Tenure:

2 months (minimum) to 15 months (maximum)

Interest Rate - Annual Percentage Rate (APR): Ranges from 21% - 30%.

APR is communicated on the BharatPe App while taking a loan.

Amount: Rs. 5100 to Rs. 10,00,000

Processing fees: 0% to 2%

An example:

Loan Amount: Rs. 1,00,000

Tenure: 6 months Interest Rate (APR): 24% per year

Repayment Amount: Rs. 1,12,000

Total Interest Payable: Rs. 100,000 x 24%/12*6 (6 months) = Rs. 12,000

Processing Fees (incl. GST): Rs. 2,000

Disbursed Amount: Rs. 100,000 (Loan Amount) -Rs. 2,000 (Processing Fees) = Rs. 98,000 Total Amount Payable: Rs. 1,12,000 (EDI of 722)

Total Cost of the Loan: Interest Amount + Processing Fees = Rs. 12,000 + Rs. 2,000 = Rs. 14,000

NBFC partners: Loans are given in partnership with RBI approved NBFCs - Hindon mercantile limited, LendenClub (Innofin Solutions Private Limited), Arthmate(Mamta Projects Private Limited), Liquiloans (NDX P2P Private Limited) and ABFL ( Aditya Birla Finance Limited). NBFC sanction letter is shown on the app and shared as a notification.

Earn up to 12%

You can earn up to 12% interest on your BharatPe account balance. Your interest is credited to your BharatPe account daily. You can add money or request withdrawal anytime. Your money is invested with RBI-approved NBFC partners.

Indias first merchant loyalty club BharatPe Club is Indias first merchant loyalty club. You can earn benefits worth Rs. 20,000 such as free cricket merchandise, zero loan processing fees, Rs.1,000 off on BharatSwipe, and Rs. 500 in a BharatPe card.

Permissions

As per the National Payments Corporation of India (NPCI) regulations, it is mandatory to enable SIM binding (Send and Receive SMS) from the users device to authenticate and authorize UPI payments. We will also need to take permissions like Location and Contacts to build your credit profile to extend loan offers. You can check the privacy policy at - Privacy Policy - BharatPe

Please note that BharatPe is the brand name of the application launched by Resilient Innovations Private Limited. BharatPe is our developer name.

Contact Information: +918882555444 [email protected] Home - BharatPe

Head Office: Resilient Innovations Private Limited (BharatPe) Building No. 8 Tower C, 7th Floor, DLF Cybercity, Gurgaon-122002 Haryana, India

RESILIENT INNOVATIONS PRIVATE LIMITED